Coming soon: Zoom Into Insurance

Next week, we are launching Zoom Into Insurance, a monthly video and podcast series where we bring together insurance professionals and innovation...

5 min read

Erik Mitisek

:

Feb 10, 2021 6:21:19 PM

Erik Mitisek

:

Feb 10, 2021 6:21:19 PM

Insurance is going through digital transformation, and despite the number of panels, articles and conversation on the topic, it still feels like a vague, ill-defined topic.

Intelligent Insurer recently surveyed 300+ commercial insurers and when asked how the prospect of technology-led transformation makes them feel, 43% of respondents indicated they were confused or concerned. This sentiment is natural for an industry facing massive change, but it’s important to note that the uncertainty is actually a key ingredient to a successful digital transformation.

Both the driver and the end goal for this evolution is client experience. Clients demand faster, easier, and more personalized service, and our industry needs to adapt to meet these demands. When it comes to how insurtech will affect this, think of insurtech as more of an enabler than a challenger.

So what does digital transformation actually mean and what does it look like? Here’s the secret: you don't actually have to know right now; not knowing where to start doesn't mean you can't start: it's actually exactly where you need to begin.

You have a vague, broad problem but can't pinpoint exactly what it is? Maybe you have an idea for a solution, but how do you know if it will work? Answering these questions is easier than you think, and we can take a page from the top startups and innovators in the world to do so.

The best part? This isn't just a topic for CIOs and executive teams, the skills these teams use can be applied to solve problems, big and small, at any level of an organization.

What we’re talking about is human centered design. Human centered design is a problem solving framework created by IDEO, a design agency known for everything from products like the original Apple Mouse to designing education systems for US cities. The framework emphasizes evidence based design with a focus on the human element in the process.

Products and services are for people, so anything we are offering them needs to start with an incredibly deep understanding of who they are, how they work, and what they want. You start by gathering evidence, then use that evidence to inform the design to a solution.

So how can the insurance industry use human centered design to innovate? Read on to find out.

The core value of commercial insurance is in our relationships. We provide our clients with security and peace of mind, and the personal element of this industry is why we will always succeed. But how well do you actually know your clients? Let’s find out!

The process goes something like this:

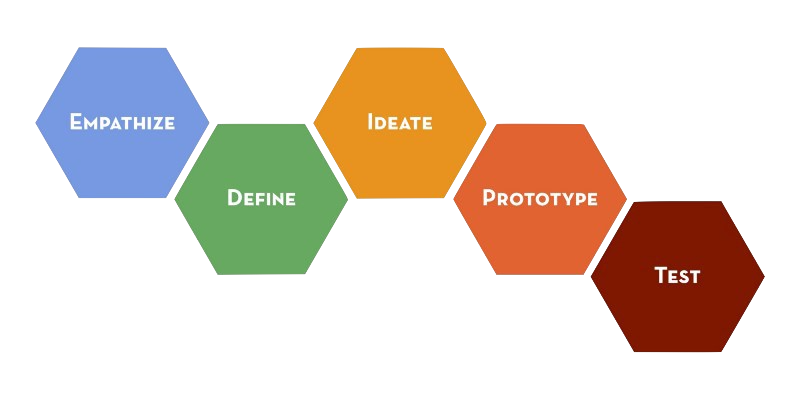

Empathize:

Interview clients and end users to find what they love & hate about their jobs, and about their experience with insurance.

Define

Take all of the feedback you got and define the main themes. This will illuminate problems or opportunity areas you can capitalize on.

Ideate

Start thinking of simple solutions you can quickly test to prove that the problem or opportunity is real and your customer will respond to a solution.

Prototype

What is the easiest, fastest, cheapest way you can verify that your idea is a good solution? Build the simplest possible version so you can prove its value before spending too much time or capital on it.

Test

Roll out your prototype to a small group and see how they respond! If it works, then your solution might be worth an investment in. If not, go through the process again armed with your new knowledge.

Let's dive a little deeper into what this looks like in practice:

Start by identifying your end clients who you are solving for. Where can you create the most impact? Maybe this is your team of brokers, or maybe it's the CFOs who are purchasing your products. Identify 5-10 of these individuals and start interviewing them about their business, their day to day work, and the insurance buying process.

Keep these interviews open ended and take copious notes.

You can use our template for empathy interviews here.

While you are conducting these interviews be sure to look for emotional language- what do they like and what do they dislike? What gets them excited and what keeps them up at night? Anything they say that indicates preferences, fears, aspirations or habits should be taken note of. Including quotes is encouraged.

Now you need to figure out what all of these quotes and observations actually mean. Go through your notes and add a broader context to each point you took note of. Once a broader context is assigned, try to determine what you can learn about the interviewee from these.

Now comes the fun part. Write all of your learnings on post it notes and put them up on a wall. Start moving the post it notes around and group similar ones together to determine themes. These themes tell you something broader about your audience.

Now it's time to determine what these themes actually tell you. Try to look at the themes and determine what they say about the broader preferences of your end client/ users. These we’ll call our Insights.

Once you have these insights; core problems or opportunities- develop “how might we” statements. A how might we statement is a basic statement about how you can solve the problem or lean into the opportunity. For example “how might we make the buying process as easy as Amazon?”

.jpg?width=600&name=marvin-meyer-SYTO3xs06fU-unsplash%20(1).jpg)

Now that you have identified core insights about your interviewees, start thinking of simple solutions you can quickly test to prove that the problem or opportunity is real and your customer will respond to a solution. Get as many possible ideas out there as you can and be sure to get input from multiple members of your team. Quantity of ideas trumps quality here.

Once you have a few different ideas for solutions, decide on one and develop a brutally simple version. What is the easiest, fastest, cheapest way you can verify that your idea is a solution? Build the simplest possible version so you can prove its value before spending too much time or capital on it.

Do this inexpensively so you can make a real investment if your solution is proven to be effective. We’ll dive more into prototyping in a later blog post, so be sure to subscribe to blog notifications.

Roll out your prototype to a small group and see how they respond! If it works, then your solution might be worth a larger investment.

In your test phase, it’s important to set clear key performance indicators and follow up with your test users to get their feedback. Similarly to the empathize phase of this process, you will want to keep things open ended and look for candid feedback on how the solution worked. Surveys are great and we encourage you to leverage them for prototype feedback, but there is no substitute for direct feedback.

If your prototype does not work as planned, don't worry! This is also part of the process and rarely will you find the perfect solution on your first pass. Human Centered Design is meant to be iterative.

When a prototype fails your test, take your learnings from the test, along with your initial insights and how might we statements and try again. If you go through this feedback loop enough times, you will eventually find yourself with a simple, validated solution based on your customers needs.

Wherever you'd like! The point of this framework is to remove assumptions about what people might want or what the core problem is; you need evidence to back up any of these decisions.

Talk with your desk level brokers, CLLs, trading partners, or end clients and go from there. You’ll be amazed at how quickly you can start to identify problem or opportunity areas once you just start asking people.

Digital transformation can be confusing, vague, and, yes, scary. Once you have the tools to work through these unknowns it becomes a lot less intimidating- even fun.

Try out a human centered design project and let us know how it goes. Want to get started? We would love to chat about how to think like a startup and digitally transforming your business. Get in touch with us here.

Next week, we are launching Zoom Into Insurance, a monthly video and podcast series where we bring together insurance professionals and innovation...

Increased efficiency will free brokers up to do what they do best: support their clients. Let's face it – the past year has brought significant...

Radical transparency. Innovation is hard enough as is, so a lack of clear expectations and communication makes it near impossible. In many...