Data Strategy in Middle & Large Market Commercial Insurance

A massive transformation is happening within the insurance world, and brokers feel the pressure. Increased consumer demand is pushing out the status...

4 min read

Erik Mitisek

:

Jun 25, 2020 12:46:30 PM

Erik Mitisek

:

Jun 25, 2020 12:46:30 PM

Companies that keep innovating can emerge stronger and gain competitive advantage

For a while now, everyone in commercial insurance has agreed that innovation is an imperative. But while many leading brokerages have invested in incremental innovation projects, few have yet achieved transformational change.

The coronavirus pandemic and downturn are forcing the industry to rethink innovation strategy. It has left some brokers wondering whether to hit the brakes or the gas pedal on innovation initiatives.

On one hand, the pandemic is accelerating and magnifying industry trends and vulnerabilities we’ve been seeing for a while, but perhaps didn’t fully appreciate. On the other hand, the downturn is forcing the industry to pare costs and focus only on essential priorities.

It’s wise to prune costs when revenue is at-risk. But cost cuts can run too deep when they put innovation goals at risk.

Read on to learn about the three key reasons brokers should avoid the brakes, and instead hit the gas pedal on innovation during the downturn.

“When a crisis hits, we are forced to confront the truth about how our systems work (or don’t). The places where things could be done better or more efficiently become glaringly obvious. All of a sudden, opportunities for innovation are staring us in the face.” - Larry Clark, Harvard Business Publishing

The COVID-19 crisis has shaken the economy and society to its core - and exposed critical industry vulnerabilities. Those that ignore these vulnerabilities are at risk.

The current global situation has forced a critical rethinking of assumptions around business continuity, communication, and how work gets done within and between organizations. Slow workflows, hard-to-access data, and inefficient manual processes are no longer an option now that people are working virtually. Customer expectations are higher than ever, and they are only increasing as the market continues to harden. They want a fast and easy buying experience and timely, actionable insights that help them manage fast-changing risks. The process of buying commercial insurance needs to speed up as customer expectations continue to rise.

Given today's extreme volatility and uncertainty, a lack of organizational agility is also a key issue. Businesses that aren’t agile aren’t resilient. Businesses that aren’t able to quickly pivot and rapidly respond to customer needs are at risk. Efficient workflows and quick access to data are a must - not only from a cost standpoint, but from a speed and flexibility standpoint. We may not know what tomorrow holds, but we need to anticipate rapid and monumental changes and quickly adapt.

“Cost-cutting is undoubtedly important at a time like this, but many companies also respond by cutting innovation and this is absolutely the wrong thing to do. A period of expansion always follows recessions and usually lasts for at least three times as long. Innovation must continue throughout a recession to prepare for this period of expansion and secure the long-term viability of the firms.” -Vijay Govindarajan, head of Center for Global Leadership at Tuck Business School, Dartmouth, 2009

Uncertainty breeds opportunity. Now is the time to prove the value of the broker relationship model. Our clients need us now more than ever as they try to manage rapid change and shifting risks. We can demonstrate value by helping them understand new risks, quickly processing claims, recommending ways to optimize coverage, and advising them how to minimize risk. In essence, our value lies in our ability to move faster than our customers, and go further for them than we have in the past.

To move faster and go further for customers, we must master our data.

Insurance is built on data. Without it, we can’t accurately assess risk, identify exposure gaps, sell just-right coverage or deliver credible insight. We must have reliable data that’s easy to access, share, and use to generate actionable insights. But a few changes are needed to take control of our data and extract its value.

First, we need fast and easy access to reliable data. Gone are the days where we could spend time searching through multiple systems, emails, PDFs and paper documents to find the data needed to power workflows and generate actionable insights.

Second, we need integrated systems and connected workflows. Rekeying data is no longer a viable way to bridge disconnected, proprietary systems. It slows us down and introduces too much security and error risk. Our systems must integrate and support connected workflows that make for a faster, easier, and more valuable customer experience.

Finally, we need standardized data formats so that data can be quickly analyzed to generate insights. Uniform data will create more value in our carrier relationships by speeding up the underwriting process and allow us to easier analyze our business more frequently and accurately.

“The species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself.” - Charles Darwin, The Origin of Species

Adaptation is key to surviving and thriving in an ever changing world.

Long before COVID, most in our industry recognized that it was time to innovate. The key question for us now as commercial insurance brokerages is, will we let short term cost concerns interfere with our long term innovation goals? Or will we use this pandemic and resulting downturn as an opportunity to adapt, re-invent, and emerge stronger?

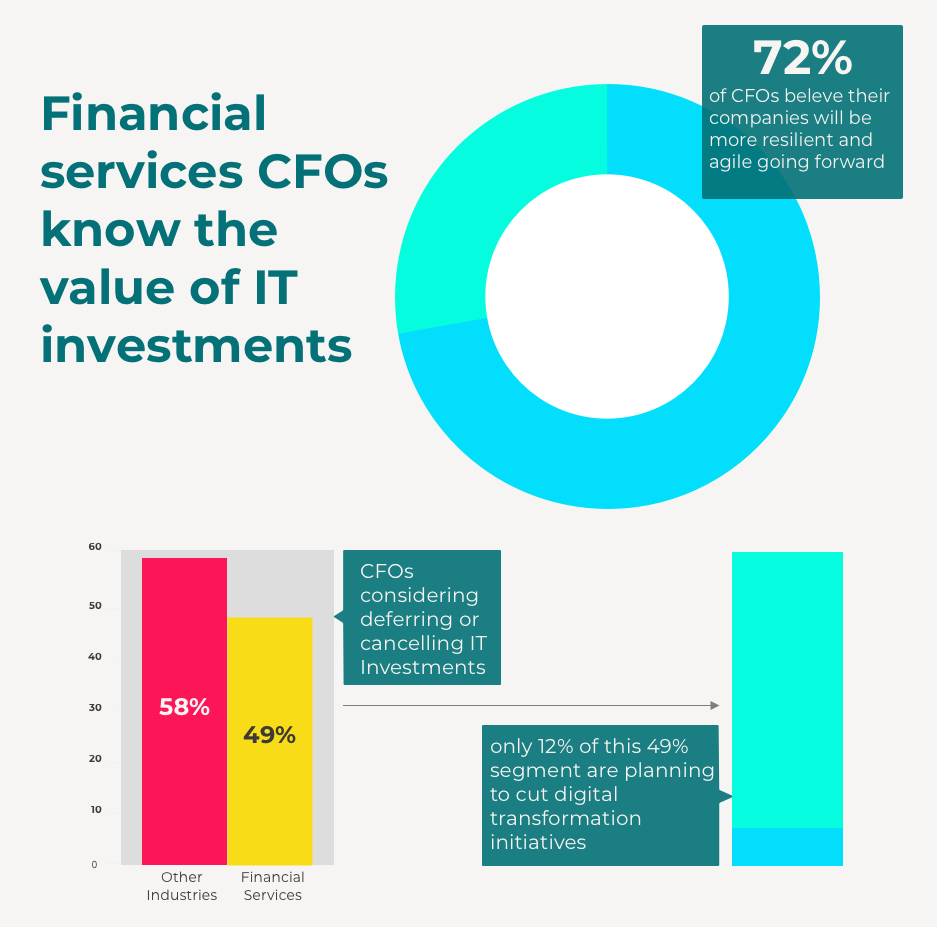

Most companies are looking at the downturn as an opportunity to gain strength and agility. In a recent PWC survey of CFOs, the vast majority (72%) believed their companies would emerge from pandemic more resilient and agile.

Financial services CFOs particularly understand the value of continued innovation and digital transformation. The majority plan to keep investing in IT and other digital transformation efforts despite a big expected decline in revenue and profit. Only 49% of financial services CFOs plan to defer or cancel IT investments and of these, only 12% are planning to cut digital transformation initiatives.

“In today’s era of volatility, there is no other way but to re-invent. the only sustainable advantage you can have over others is agility, that’s it. Because nothing else is sustainable, everything else you create, somebody else will replicate.” — Jeff Bezos, Amazon founder

The downturn may well trigger a competitive reshuffling in which those who keep innovating ultimately gain competitive advantage over those who don’t. Roughly half of financial services companies plan to keep their foot on the innovation gas pedal so they can emerge as stronger, more agile competitors. Will you be among this group who sees the pandemic as an opportunity to adapt, survive, and thrive?

Highwing’s open data solutions give brokers the speed and flexibility they need to move faster and go further for clients. Click here to learn more.

A massive transformation is happening within the insurance world, and brokers feel the pressure. Increased consumer demand is pushing out the status...

Last month the largest free event of its kind, Denver Startup Week, kicked off in Denver and the Highwing team was excited to participate. We are...

Think about the most innovative companies in the world. Names like Apple, Amazon, and Tesla likely come to mind. And you wouldn’t be wrong. These...