Digitize Faster with Less Risk: MVPs in Insurance

The heat is on! As businesses demand faster, more efficient, personalized insurance solutions, brokers face increasing pressure to adapt and...

6 min read

Erik Mitisek

:

Aug 14, 2023 5:50:00 PM

Erik Mitisek

:

Aug 14, 2023 5:50:00 PM

A massive transformation is happening within the insurance world, and brokers feel the pressure. Increased consumer demand is pushing out the status quo, mergers and acquisitions are bolstering the competition’s competencies, and new entrants are crowding an already congested space.

Keeping pace meant making regularly scheduled updates to internal systems and software. Unfortunately, this is no longer the case as the pace of technology has accelerated past the monolithic, siloed systems the industry has relied upon for more than two decades. The legacy these outdated programs have left is mountains of incomplete, non-uniform, and stagnant data.

Today’s broker will move only as fast as its data. Therefore, organizations must adopt innovation as a business function where data quality, uniformity, and accessibility form the foundation. Once the groundwork is laid, digital transformation can take place, and brokers will be armed with the tools necessary to lead in the next era of insurance.

To showcase how embracing innovation can accelerate broker growth, we share a real-world success story of a broker using data-driven insights to their advantage. But, before we get there, we first must understand where the state of data in our industry is today.

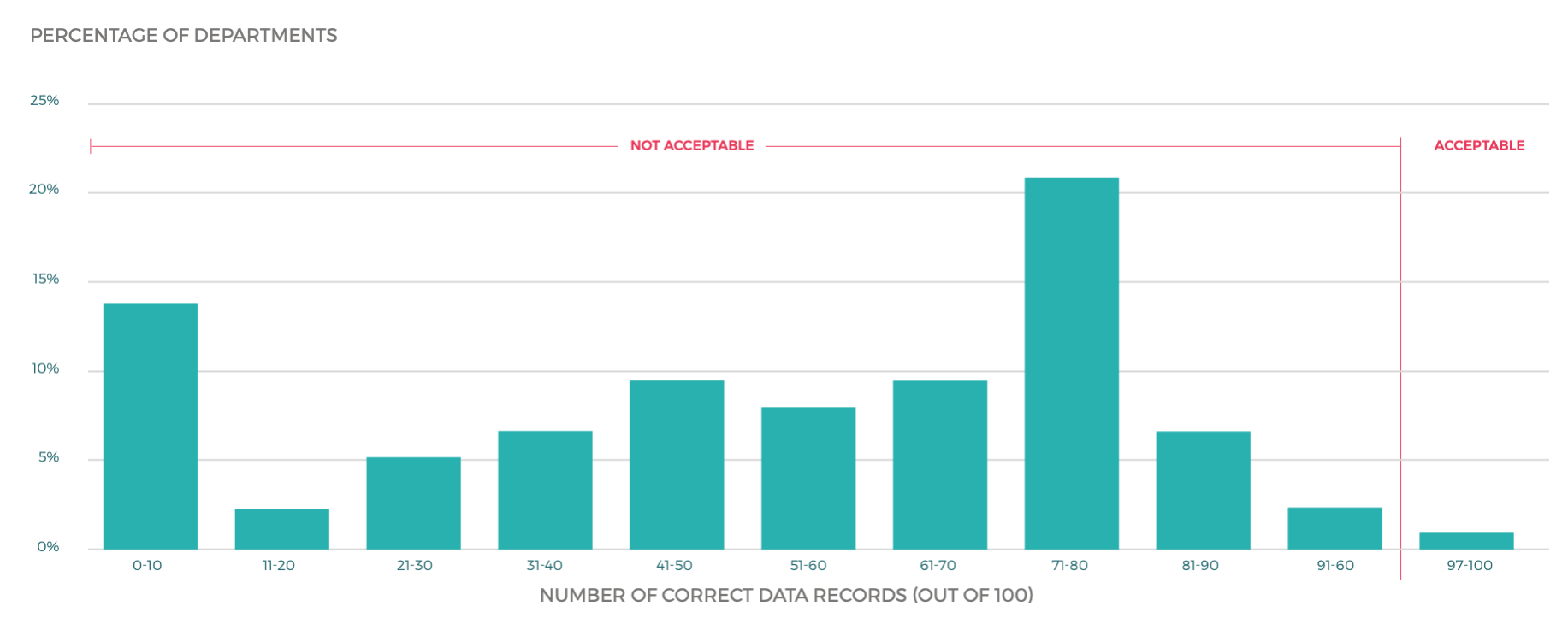

A study involving 75 executives found that only 3% of their departments fell within the minimum acceptable range of 97% data accuracy. In other words, nearly every department had at least four incorrect data records out of 100.

An accuracy rate of 97% may seem extreme. However, correcting data errors is not only time-consuming, but they are also exceptionally expensive. For a matter of perspective, let’s consider “The Rule of 10,” which has been applied to any linear application from software design to assembly lines.

The concept asserts that the cost to complete a unit of work is 10x’s higher when the input is defective than if the input were perfect. Using a machine manufacturer as an example, the rule of 10 looks something like this:

|

Level of Completion |

Cost to Repair Defect |

|

The part itself |

X |

|

At Sub-Assembly |

10 X |

|

At Final Assembly |

100 X |

|

At the Customer |

1000 X |

The longer it takes to discover an error, the more costly it becomes. In the example above, a $1 part would cost the manufacturer $100 to find and repair during final assembly. We have seen this play out with automobile makers where a cheap, defective part costs billions in a recall.

Like an assembly line, the underwriting process is also a linear application. However, instead of parts, we are working with data where an error is paid for with time and energy. Time and energy better served for much more profitable endeavors.

How does your data stack up?

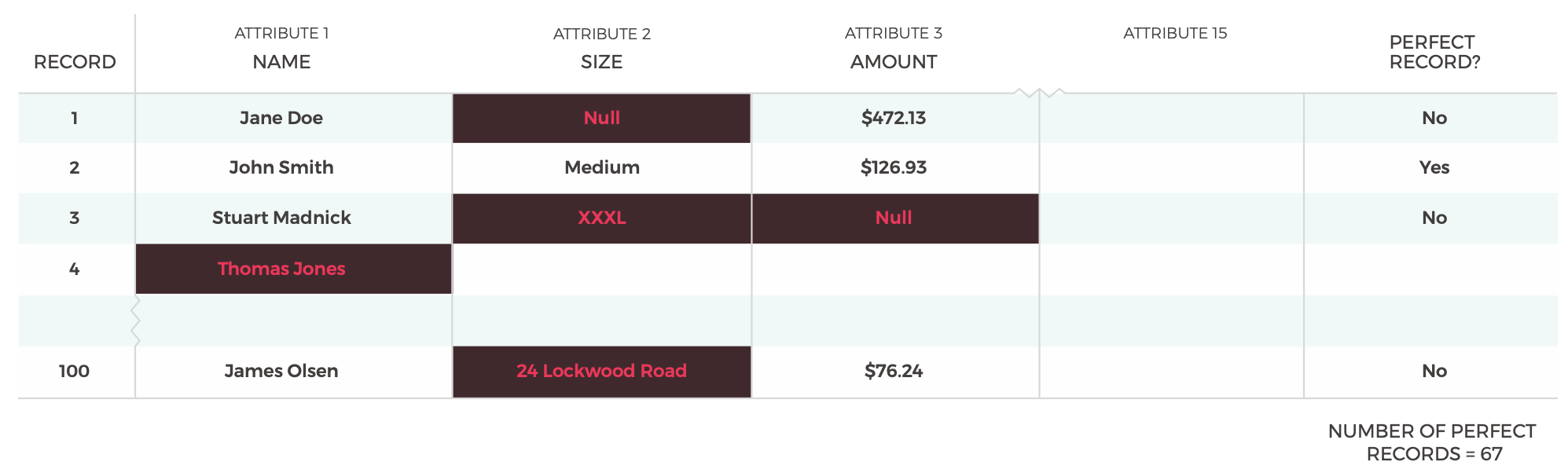

Fortunately, there is a simple exercise you can do to gain a glimpse of the quality of your brokerage’s data. Pull the last 100 bind orders and identify how many records are error-free using the following steps:

The above is a quick way to determine how often minor data inconsistencies are leaking into your everyday processes and records. The results provide a quantifiable figure to use in prioritizing where data quality needs to be improved.

Most brokers have realized the need to innovate. This was the case with one of our broker partners who wanted to understand how to extract value from their most important assets - their data.

The broker was feeling pressure from the competition where they were losing ground on their speed from submission, to quote, to bind. The challenge required a wide-reaching approach to data policy encompassing data siloed between different systems, clients, partners, and markets. There was a seemingly infinite amount of value to be gained from their data, and the broker set forth their goals in working with Highwing:

This broker, like many others, was already busy managing relationships with clients and partners, underscored by overseeing the processes keeping the company going. The amount of expendable time for a data quality project was virtually non-existent. For our partnership to succeed, we knew their digital transformation would need to be simple, measurable, and exceptionally impactful.

A journey of a thousand miles begins with the first step. In the case of digital transformation, the first entails an analysis of the state of data within your brokerage. At Highwing, our process involves an in-depth evaluation culminating in a comprehensive data quality report.

Our assessment aims to identify areas within the brokerage ripe for improvement. Hard numbers are crunched, proficiencies are determined, and data gaps are revealed. But for simplicity, we want to ascertain if a broker maintains a novice, competent, or expert level of data competency.

Ask yourself, “what is the data state of my brokerage?” using the following descriptors:

Novice Data States – Brokerages considered to be in the Novice Data State would describe their operation as follows:

Competent Data States – Brokerages considered to be at the Competent Data State would describe their operation as follows:

Expert Data States – Brokerages considered to be at the Expert Data State would describe their operation as follows:

Reaching the Expert Data State takes a commitment from all company levels. Most important is that executives set the standard for creating a culture of data integrity. As we learned, even a tiny creep of faulty or incomplete data can be costly.

However, ask yourself what your brokerage could gain by operating in an “Expert Data State”:

The answers to these questions should excite you. Digital transformation touches every aspect of a broker’s organization, and when done correctly, the results can make how you used to do business unrecognizable.

Determining your data state can be a very humbling process. Yet, so many challenges standing in the way of reducing friction between brokers, carriers, and clients lie within your data. These hurdles are why analyzing your data and creating a data quality report is the most intensive and vital step within the digital transformation process.

Our partner broker, mentioned above, was entering a competent data state and realized how much further they had to go. Producing a data quality report was our first step. For every data point, regardless of its significance, we computed the broker’s completeness and conformance across the entire organization. Additionally, we included quality metrics that vary per field based on the semantics of the data model.

Once reporting was completed, we provided the roadmap to normalize and enrich their data. The result was a complete, malleable, and agile dataset enabling the broker to access many new analytics and insights. Data became deployable instantly, and their internal processing speeds increased exponentially.

Just the ability to reign in their data and use it efficiently and meaningfully is a game-changer. Yet, the most significant advancement is the broker’s new ability to integrate and automate many of the broker’s most complex and time-consuming processes. The Highwing platform is now allowing our partner broker to:

The measurable benefits for our partner broker have been more than impressive. But perhaps just as notable are the deepening their relationships have become with both their carriers and clients.

Data, both internal and accessible through your partners, is your brokerage’s most valuable asset. But incomplete information living in monolithic, siloed systems prevents brokers from unleashing its true value and power. Any meaningful innovation is handcuffed until data becomes complete, normalized, and easily accessible.

The foundation of Highwing’s marketing platform is built upon decades of examining insurance data and analyzing all its potential. Data is the key to unlocking the speed required to thrive in the industry’s next era of digital.

The heat is on! As businesses demand faster, more efficient, personalized insurance solutions, brokers face increasing pressure to adapt and...

For generations, the commercial insurance industry has thrived on a foundation of trust, expertise, and personalized service. Brokers have built...

Think about the most innovative companies in the world. Names like Apple, Amazon, and Tesla likely come to mind. And you wouldn’t be wrong. These...